Sending and receiving money online is not always as easy as we would like it to be. Purchasing items online is easy enough, with merchants offering a variety of payment methods, but when it comes to transferring cash, it’s a different matter. Not only can it be a slow process, but you might also end up having to go the old-fashioned way at the end of the day.

That’s where Square Cash comes into the picture.

Square Cash comes from the already well known group Square Inc., which made its name in the smartphone-swiping device niche. Many a small merchant has had their business much improved by solutions from Square Inc., and this time, the private individual can take advantage of this new way to send money online.

The solution may not be elegant, but it’s so simple. All you need to do is to use your email to send money.

How exactly does Square Cash work?

There are three steps:

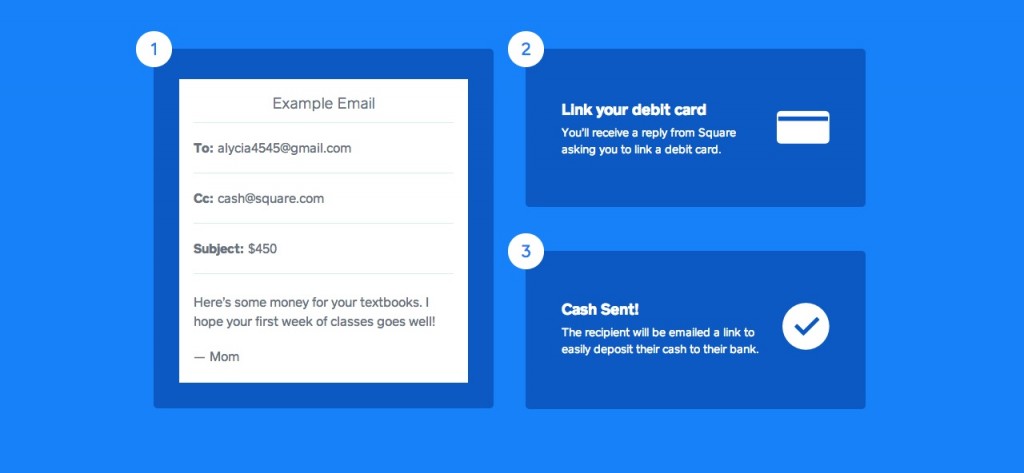

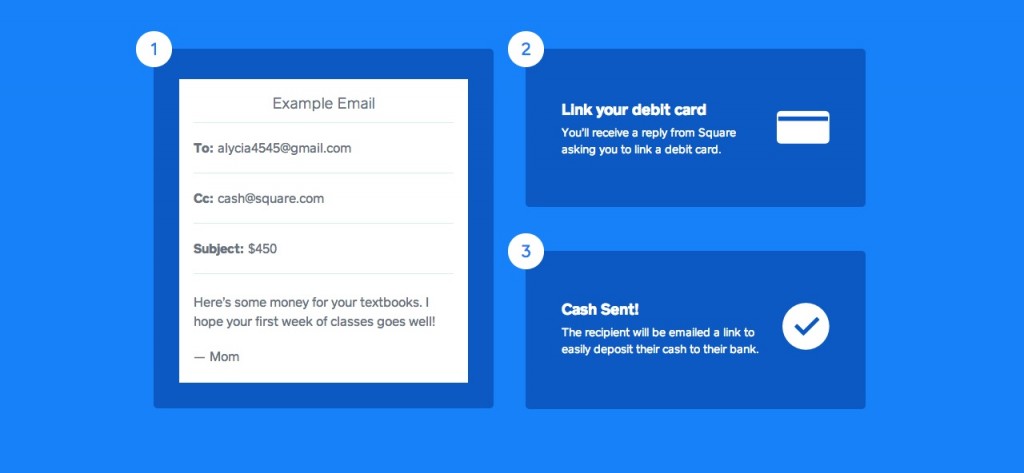

Here’s a visual representation.

As you may have reasoned out by now, Square Cash needs a debit card, which Square uses to deposit the money into the bank account that you specify.

Any US debit card with a Visa or Mastercard logo will work, but it is important to note that this works in the US only – only for now, hopefully. There is also a limit of $2,500 per week; whether you send this all at once or you spread it out over several transactions does not matter.

Walt Mossberg himself has tested Square Cash, and his review just might seal Square Cash’s reputation. One thing that stands out to me in his review:

Fair warning, but it is also worth noting that with any transaction we make online, we have to trust the entity behind.

For now, US consumers have an easier (and seemingly secure) way of transferring money without much hassle. Is this goodbye PayPal?

That’s where Square Cash comes into the picture.

Square Cash comes from the already well known group Square Inc., which made its name in the smartphone-swiping device niche. Many a small merchant has had their business much improved by solutions from Square Inc., and this time, the private individual can take advantage of this new way to send money online.

The solution may not be elegant, but it’s so simple. All you need to do is to use your email to send money.

How exactly does Square Cash work?

There are three steps:

- Send an email to the intended recipient, with cash@square.com in copy.

- Link your debit card. You will do this upon receiving an email from Square Cash.

- Done!

Here’s a visual representation.

As you may have reasoned out by now, Square Cash needs a debit card, which Square uses to deposit the money into the bank account that you specify.

Any US debit card with a Visa or Mastercard logo will work, but it is important to note that this works in the US only – only for now, hopefully. There is also a limit of $2,500 per week; whether you send this all at once or you spread it out over several transactions does not matter.

Walt Mossberg himself has tested Square Cash, and his review just might seal Square Cash’s reputation. One thing that stands out to me in his review:

You have to trust Square. The company has a strong track record in its merchant business, so it isn’t brand new to the money-transfer business. And Square says it has strong security measures and close human and machine monitoring for possible fraud. If fraud is suspected, the company says it can and will reverse the fund transfer. Still, digital services do get hacked, and email can be manipulated by thieves.

Fair warning, but it is also worth noting that with any transaction we make online, we have to trust the entity behind.

For now, US consumers have an easier (and seemingly secure) way of transferring money without much hassle. Is this goodbye PayPal?

0 comments:

Post a Comment